Decision Making Villain #4- Prepare to be Wrong

In my last blog post I told you of a decision I made to leave my long-term leadership role to start a new business. It was exciting, scary, bold and in some ways stupid. Many things could have gone wrong.

“What if…

- I couldn’t find any clients,

- I couldn’t pay my bills,

- I wasn’t good at being a leadership consultant who works with leaders and their teams to improve clarity, unity and performance?”

Many of us make decisions that are laced with over-confidence. I’m all for confidence. However, when it comes to GOOD decisions, over-confidence is a deadly trait.

Overconfidence bias is a tendency to hold a false and misleading assessment of our skills, intellect, or talent.

Overconfidence is one of the largest and most common biases to which human judgement is vulnerable. In his 2011 book, Thinking Fast and Slow, Daniel Kahneman called overconfidence “the most significant of cognitive biases…an excessive faith in ourselves and our judgement means that we too often ignore our vulnerability to bias and error cast of the cognitive biases.”

There are many examples of this:

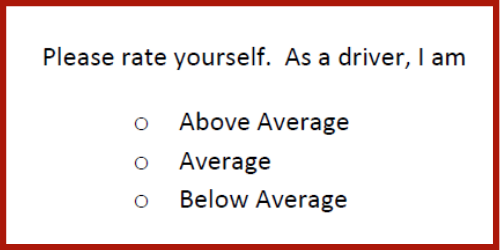

- 93 percent of American drivers claim to be better than the median, which is statistically impossible.

- In an experiment that was conducted in which two groups of people (economists and zookeepers) are asked to predict the price of oil in five years’ time. Strikingly, the economists and the zookeepers are equally inaccurate in their predictions, but the economists attach much more certainty to their forecasts than the zookeepers, for obvious reasons. The economists were over-confident; despite the fact their predictions weren’t even discernibly different from a group with almost no knowledge of oil prices. The zookeepers and economists had equal accuracy when it came to foreseeing the future of oil prices, and neither of them had a clue!

SO WHAT?

When we make decisions often we believe we are unique and that the potential downside (if we see it at all) won’t happen to us. This leaves us exposed and unpleasantly surprised when our decision doesn’t work out as expected.

Of course, we need to back our judgement and have some level of confidence and courage. Therefore a middle way, between too much and not enough confidence needs to be found. This ‘Goldilocks zone’ of confidence is where rational beliefs meet reality. It is based on truth and good sense. It is built on beliefs that can be justified by evidence and honest self-examination. It steers between the perilous cliff of over-confidence and the quicksand of under-confidence. It is not always easy to find this narrow path; it takes honest self-reflection, level-headed analysis, and the courage to resist wishful thinking.

In Decisive (2014) Heath and Heath suggest a number of techniques to land in the ‘Goldilocks zone’ which is summed up with the phrase: Prepare to be Wrong.

1. Bookending

This technique seeks to create a best and worst case scenario. A good example is of an investor looking to buy a stock. Often investors try and work out what the target price of a stock should be. Bookending asks; “What are the worst and best conditions for this stock to operate? In those conditions what would be the stock price?” This gives a range – a high and a low – from which an investor can work out when a stock is a good investment.

Another example of bookending was when I was leaving my job. I asked: “What is the best and worst that could happen? If the worst happens what is my plan B?” This is the equivalent of insurance. We hope we don’t need to use it but it is unwise not to have it when making decisions. Creating a range of best and worst options stops us from locking in on a particular ‘correct decision’, which is more likely to be wrong than right.

2. Pre-Mortem

A second strategy is to work backwards from an option. When we use this strategy we seem to come up with more insights. A post-mortem asks after a decision is executed, “How and why did the project die?” A pre-mortem asks before a decision is executed, “Imagine the project died, what killed it?”

“Using ‘prospective hindsight’ to work backward from a certain future— (we) are better at generating explanations for why the event might happen” (Decisive, p.202).

Pre-mortems help us to ‘Prepare to be Wrong’. Using these two techniques help us not to focus on a single, usually overly optimistic guess about how the world will unfold. We make plans to combat potential threats to our decisions or plans. When we are overconfident we don’t adequately prepare for problems. A pre-mortem helps to widen our focus and adapt our approach or put in contingencies against the risks because we have conceived of any threats.

3. Trip-Wires

The last helpful approach to combat overconfidence is to create a ‘trip wire’. A trip wire is a predetermined point at which you will change your decision or your plan. For instance, my trip wire when leaving my job could have been; “If I have gone 3 months without making $20,000 then I will start applying for jobs.”

“A tripwire can snap us awake and make us realise we have a choice. Tripwires can be especially useful when change is gradual.” (Decisive, p.225)

We have all had the experience where we have set our course; invested a lot of time, effort and money, and then resisted changing because of the dynamic of ‘sunk costs’. Think of the poker player who has bet half their kitty, they suspect that the other player has a better hand, but to fold would be humiliating and costly. They go ‘all-in’ in the hope that the odds will change and they will be a big winner.

Trip-wires also reduce the pervasiveness of being on autopilot. We have made decisions previously and we haven’t noticed or chosen to ignore that they are no longer working. Maybe you’ve invested in a superannuation account and you never check its performance against other funds. Maybe you have employed someone who consistently underperforms, but you want to be loyal. You reason, the daily underperformance doesn’t seem that big.

“At some point, the virtue of being persistent turns into the vice of denying reality.” (Decisive, p227)

A familiar trip-wire is to set a deadline such as annual financial reporting or annual employee reviews. Another is, “when this happens, then I will….”.

The positive part of trip-wires is that they allow us to experiment within a range of tolerance.

Overconfidence about how the future will unfold – we cannot examine what we can’t see or know. Being prepared to be wrong is critical to making good decisions.